Investment in mutual funds, debentures/bond, shares, buyback of shares exceeding Rs 10 lakh in a financial year.ĥ. Payments of bills of one or more credit cards of Rs 10 lakh and above by a person in a financial year.Ĥ. Cash payments made by any person totaling over Rs 1 lakh in a financial year.ģ. Transactions involving cash deposits aggregating to Rs 10 lakh or more in a financial year.Ģ. Now, all such information under the different specified transactions will be shown in the new Form 26AS.Īfter the introduction of this form 26AS the income tax authority will come to know record details of ġ. from “specified institutions” like banks, registrars or sub-registrars, mutual funds, and bonds issuing institutions.

The Central Board of Direct Taxes (CBDT) said the Income Tax Department used to receive higher value information like sale/purchase of immovable property, cash deposit/withdrawal from saving bank accounts, purchase of shares, buyback of shares, debentures, time deposits, foreign currency, credit card payments, purchase of mutual funds, cash payment for goods and services, etc.

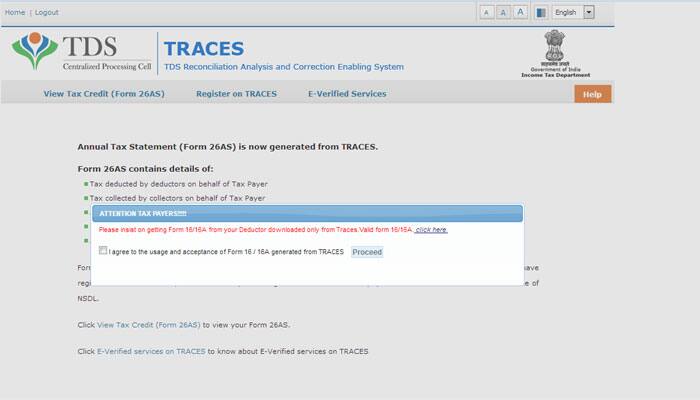

The basic intention behind its introduction is to fetch information about the transactions of higher values. The Finance Minister had announced about the Form 26AS in the Budget 2020-21. Hence Form 26AS is a consolidated annual tax statement that includes information on tax collected/deducted at source, self-assessment, and advance tax. Earlier the tax authorities used to get this information from the financial institutions. This form will reflect details of all high-value transactions made by the taxpayers. You can find it from the website of the income tax department with the help of your PAN number.

0 kommentar(er)

0 kommentar(er)